When Renewable Energy Meets Power Grid Operations

The electric power industry faces much turmoil in the coming decades. The business model of the electric utility company (public or private) may not survive. In addition, the power needs of high-density cities may diverge significantly from non-urban areas causing political turmoil and technical hurdles.

The increasing share of renewable energy will be a major factor in the turmoil. It can be viewed as a coming of age. When the percentage contributions of solar & wind to the power grid were small enough, it didn’t matter how they behaved. But as their share grows, renewables become significant and ultimately dominant.

There’s nothing new about turmoil, or upheavals. Technologists are sometimes proud of the disruptive nature of their inventions. But in the case of electric power, we must never stumble in the reliable supply of electricity, not even for brief periods. A total revamp while maintaining continuous operation is like reupholstering the seats in your car as you drive down the highway.

I am talking about the future. No, I do not own a crystal ball. My approach is to describe the essential properties of a reliable power grid that must remain invariant despite turmoil, conflict, and invention. If renewables are to dominate the future, then renewables must take over these necessary functions. This article may be a bit wordy but bear with me.

Design and operation of the bulk power grid have been my career. My examples come from the State of New York, USA. In other states and countries and other utility structures, the nomenclature and ownership details may seem very different, but the things I describe here are analogous to power grids anywhere in the world.

Table of Contents

Caveat

This article discusses the bulk power system and the wholesale markets, not distribution not retail, personal use personal costs, or personal production. To understand this article, you must think of energy supply at the level of continents, not individual homes or neighborhoods or even individual countries.

Operating the Grid — Balance Generation and Load

The power grid is demand-driven. Customers create demand, for example by turning on a light. The grid must satisfy this demand instantaneously, creating a balance: generation=load+losses. For purposes of this article, I will neglect losses and say generation=load. It would be correct to say production=consumption, but I prefer generation=load. Our foundational physics principle is the conservation of energy.

The power grid stores no energy, so this balance must be applied instantaneously. Energy storage we can treat as external devices attached to the grid. They are not part of the grid itself. In an earlier Insights article, I discussed maintaining the balance over a wide range of time intervals; the longest interval ##10^{18}## times longer than the shortest. In this article, we’ll zero on on a mere ##10^{5}## range of time intervals from about a minute to a year.

So that’s it. Customers demand power whenever and wherever they want to. The industry must ensure that generation matches the load and delivers that energy to the customer’s location in all reasonable circumstances at an affordable price. Pretty simple huh?

The Solution: Find the Optimum Allocation Among Multiple Sources

It is necessary to have multiple resources and multiple ways to meet the demand. Each resource has different properties, a geographical location, and a price curve. Therefore, the technical problem is reduced to simple optimization. Find the optimum combination of resources to make generation=load subject to constraints. The familiar Simplex method is widely used to do that. We repeatedly solve that problem once every hour for the next 24 hours, once every 15 minutes for the next hour, once every 5 minutes for the next 15 minutes, and in a limited sense once every 2 seconds for the coming 5 minutes.

Now let’s talk about the scale of the problem. The New York grid is a network with roughly 20K nodes and 100K branches. It is a linear passive electric circuit. The nonlinear boundary conditions are the power flows entering/leaving the grid at each node. Ohm’s Law, Kirchoff’s Laws, and matrix methods are the primary tools used to solve it. During optimization, every vertex considered must calculate the voltages at all nodes, and the power flows in all branches.

The geographical and electrical locations are critically dominant factors. We can and we do generate electricity near Hudson’s Bay in Canada that is consumed in NYC, but we can’t do it as reliably as power generated locally on the island of Manhattan.

As a prerequisite to the circuit solution, we need to decide what circuit is being solved. To do that, we run a state estimator program. Think of a large and geographically distributed data acquisition system with partially overlapping measurements. Add to that, manually entered parameter values which may be inaccurate. Some data is inevitably incorrect or missing. Even circuit breaker statuses can be misreported. Entire remote telemetry facilities can be wiped out. The data will never be perfect, but the calculations need to be executed nevertheless. The state estimator provides us with the best guess for the actual circuit and boundary conditions that need solving; a guess that completely obeys Ohm’s Law and Kirchoff’s Laws.

Now think of constraints. Every node has a maximum and minimum voltage. Every generating source has a max and min power and a max ramp rate of change. Every transmission line has a weather-dependent max power rating and a short-term overload capability. About 150K constraints may not be violated.

Next, come contingencies. Every branch in the network and every generating source may fail during the period considered. We apply all contingencies to every possible solution and verify that no constraints are violated. If a violation is predicted, that solution is discarded. We apply all contingencies singly to the entire state, all combinations of contingencies taken 2 at a time to NYC, and all combinations took 3 at a time for the island of Manhattan. Altogether about 250K contingencies are evaluated for every vertex in the Simplex solution. Remember that each of those 250K calculations requires solving for 20K voltages and 100K power flows. It makes for a lot of number crunching.

Sometimes constraints can consider emissions. For example, there used to be some older power plants in NYC that could burn dirty oil or cleaner gas. Naturally, it was policy to use gas as much as possible. But one contingency was the loss of the gas pipeline. So in rare cases, the plants were ordered to burn dirty oil if it was determined that the grid could not survive the loss of that gas pipeline. The optimum solution would calculate the maximum amount of dependency on gas.

After all that complexity, what is the objective function to be optimized? It is a single scalar number; total cost.

The Energy Auction

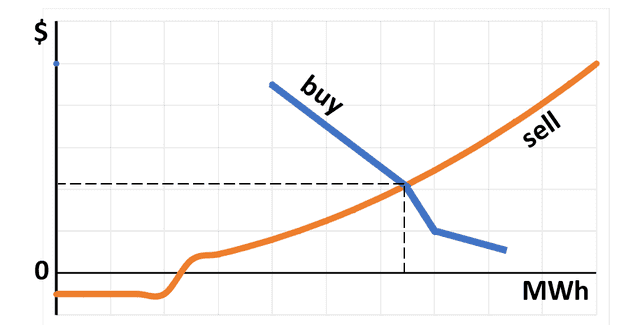

Costs are determined by an auction. Each seller and each buyer provides one or more bids; each bid for a specified MWh quantity, and a dollar price. The bids are ordered and cumulative curves a drawn. The intersection of the curves is the solution. The dotted lines in the figure show the clearing price and the clearing quantity. All bids to the left of the clearing quantity are accepted and all are paid the clearing price regardless of their bid price. All bids to the right are rejected; those sellers and those buyers go home empty-handed.

That auction method is the same as stock markets use to determine stock prices and quantity bought and sold.

Note that part of the selling curve is negative. Remember that for later in this article.

It is easy to visualize prices fluctuating in response to changes in the supply curve or the demand curve. During heat waves, demand is high. During economic recessions, demand is low. When a power plant breaks down, the supply curve shifts. Solar and wind supply for tomorrow depends on tomorrow’s weather forecast. Price volatility depends on how steep the slopes of those curves are. For example, gasoline prices all over the USA increased about 10% in the past month because of mechanical problems at a single refinery. There is no defined limit to how close to vertical those curves can be.

Of course in real-time, utilities have no flexibility; they must buy whatever retail power customers demand. However, the biggest auction is held the day before, so the utility has the option to buy some energy in advance or buy the rest later.

Other Vital Services

Reserves: Things break. We must have spares and backups for the times when they do break unexpectedly. Therefore we require power reserves on the order of 15-20% of the load. Reserves are generation capacity that is paid to be ready but not generated. In NY, we buy reserves of three types: instantaneous, 15-minute notice, and 30-minute notice. The price paid for reserves is determined by a separate auction.

Frequency control: Any unbalance between generation and load+losses results in the frequency going up or down. Some fraction of generating capacity must be available to follow that second-by-second in closed-loop control to keep frequency reasonably constant. A generator must run below 100% capacity to be able to respond up/down on command. Prices for frequency response are determined by a separate auction.

Voltage Support: This is mostly a question of reactive power; VARS. The network may need plus or minus VAR generation at strategic points to help maintain voltages within limits. The price paid for voltage support is determined by a separate auction.

Black Start: After a blackout (horrors!!!) the grid must be restarted. That is not necessarily easy. After the 1965 NE blackout, power plants on Long Island had to burn office furniture to light the fires. Most power plants need electricity to operate their controls. The grid needs sources capable of starting without outside help and with enough capacity to energize the entire grid so that other generators can be started and loads reconnected. The price paid for black start capability is determined by a separate auction.

Demand Response: To balance generation=load+losses, it should make no difference whether we increase generation by 1MW or decrease the load by 1MW. A few customers, who have the flexibility to put their loads under the computer control of the grid operator are paid handsome fees to do so. For example, mining and rock crushing. Some of them can crush enough rock for a year’s product with only one 1-month of operation of the crushers. That gives them great flexibility in scheduling when they consume electricity. In the future, demand response providers may participate directly in the energy auction.

ICAP: ICAP is short for installed capacity. There must be sufficient generating capacity ready to bid in the energy markets for each region. If utilities own all the resources, the government requires them to provide adequate ICAP. If not, the government requires them to purchase it from third parties. Yet another separate auction can be used to buy and sell ICAP.

Suppose New York is short on ICAP for next year. Third-party investors may be sour on NY, thinking that profits are too low there to be profitable. What can be done to motivate them to build a new power plant in time for next year? Bribe them of course. ICAP payments are the bribe. There have been legal fights over whether states have the authority to mandate that certain percentages of ICAP be renewable. There are also legal fights in some places about the eligibility of solar and wind for ICAP payments.

What is the difference between reserves and ICAP? Mostly the time scale. Reserves are bought for tomorrow, ICAP for next year.

Renewables Take Over

Energy/Reserves/Frequency Control/Voltage Support/Black Start/Demand Response: those are the essential invariant services of the grid. Heretofore they have been provided by conventional means, especially hydro and steam power plants. Note that all services except energy require that the provider produce less than the maximum possible power.

As solar and wind grow as a fraction of the total, they must assume a share of the responsibilities. If they take over 100% as many people dream of, they have 100% of the responsibility. Opinions about what fraction they should be are irrelevant.

We already have a problem. Remember the negative portion of the sell curve? That is real, and in certain locations every once in a while the clearing price goes negative. Generators must pay for the privilege of producing power. Nuclear plants make negative bids because they can not shut down for just one hour and restart for the next hour when power demand is higher. Solar and wind generators can make negative bids because they can make a profit with subsidies alone even if they pay to the grid for the privilege. Negative prices used to be rare, but it is happening more and more often in more places, and that threatens the whole financial model.

If you understood this article, you see how the technical operation of the grid is intimately co-dependent on the economics and financial auctions. Auctions have a critical assumption — the cost-versus-production-curves must have nonzero slopes. That does not apply well to wind and solar. If negative prices become too frequent, the auction system collapses and we must find something other than money to be the objective function for optimization. What could that something be? I have no idea. But the prospect of such a fundamental change threatens disruption, and disruptions in the delivery of energy are unacceptable.

Even experimentation and change with fundamental markets are risky. We are talking about hundreds of billions of dollars per year. The incentive to steal, cheat, or manipulate is huge. If you remember, we already saw what happened in 2000 with disastrous rolling brownouts in California. There, the crooks proved to be more clever than the market designers, and much more clever than the regulators. Innovation and prudence do not mix well for vital services.

In most contexts, I am a stalwart advocate of change, but in this case, change scares the hell out of me. My fears apply equally to regulated, deregulated, public, and private electric industries.

Dick Mills is a retired analytical power engineer. Power plant training simulators, power system analysis software, fault-tree analysis, nuclear fuel management, process optimization, power grid operations, and the integration of energy markets into operation software, were his fields. All those things were analytical. None of them were hands-on.

Dick has also been an exterminator, a fire fighter, an airplane and glider pilot, a carney, and an active toastmaster.

During the years 2005-2017. Dick lived and cruised full-time aboard the sailing vessel Tarwathie (see my avatar picture). That was very hands on. During that time, Dick became a student of Leonard Susskind and a physics buff. Dick’s blog (no longer active) is at dickandlibby.blogspot.com, there are more than 2700 articles on that blog relating the the cruising life.

Leave a Reply

Want to join the discussion?Feel free to contribute!