mathmari

Gold Member

MHB

- 4,984

- 7

Hey! :giggle:

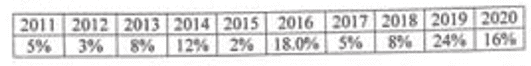

Analyst has collected the following data on the performance of the $X$ stock for $10$ different years.

a) Calculate the arithmetic mean, the median, the mode, the standard deviation, the coefficient of variability and of asymmetry. You interpreted your results.

b) Does the data have extreme values (consider the cut-off limit $z = \pm 2$ or $z = \pm 3$).

c) The analyst claims that the average yield next year will be at least $7.5\%$. Is the claim correct? Do you think you would have an increased risk if you bought the $X$ share?

I have done the follwoing :

a) The arithmetic mean is $$\frac{5\%+3\%+8\%+12\%+2\%+18\%+5\%+8\%+24\%+16\%}{10}=\frac{101\%}{10}=10.1\%$$

For the median, we write the percentages in an increasing order then we calculate the half of the sum of $5$-th and $6$-th percentage.

Therefore the median is equal to $$\frac{8\%+8\%}{2}=8\%$$

The modeis the value that appears most often, so $8\%$.

For the standard deviation wesubtract from eachgiven value the mean, square the result and take the sum, divide that by the number $10$ and take the square root, right?

So we get $$\sigma=\sqrt{\frac{1}{10}\left [(0.05-0.101)^2+(0.03-0.101)^2+(0.08-0.101)^2+(0.12-0.101)^2+(0.02-0.101)^2+(0.180-0.101)^2+(0.05-0.101)^2+(0.08-0.101)^2+(0.24-0.101)^2+(0.16-0.101)^2\right ]}=\sqrt{\frac{1}{10}\cdot 0.04709}\approx 0.0686$$

The coefficient of variability is $$CV=\frac{\sigma}{\mu}=\frac{0.0686}{0.101}\approx 67.92\%$$ The coefficient of asymmetry is \begin{align*}\beta_1&=\frac{1}{10}\cdot \sum_{i=1}^{10}\left (\frac{x_i-\mu}{\sigma}\right )^3\\ & =\frac{1}{10\cdot \sigma^3}\cdot \left [\left (x_i-\mu\right )^3\right ]\\ & =\frac{1}{10\cdot 0.0686^3}\cdot \left [(0.05-0.101)^3+(0.03-0.101)^3+(0.08-0.101)^3+(0.12-0.101)^3+(0.02-0.101)^3+(0.180-0.101)^3+(0.05-0.101)^3+(0.08-0.101)^3+(0.24-0.101)^3+(0.16-0.101)^3\right ]\\ & =\frac{1}{0.00322828856}\cdot 0.00221772 \\ & \approx 0.68696\end{align*}

Is everything correct so far? How can we interpret the results?

b) Could you give me a hint for that?

c) Do we have to check what distribution we have in this case? Or how can we know that?

Analyst has collected the following data on the performance of the $X$ stock for $10$ different years.

a) Calculate the arithmetic mean, the median, the mode, the standard deviation, the coefficient of variability and of asymmetry. You interpreted your results.

b) Does the data have extreme values (consider the cut-off limit $z = \pm 2$ or $z = \pm 3$).

c) The analyst claims that the average yield next year will be at least $7.5\%$. Is the claim correct? Do you think you would have an increased risk if you bought the $X$ share?

I have done the follwoing :

a) The arithmetic mean is $$\frac{5\%+3\%+8\%+12\%+2\%+18\%+5\%+8\%+24\%+16\%}{10}=\frac{101\%}{10}=10.1\%$$

For the median, we write the percentages in an increasing order then we calculate the half of the sum of $5$-th and $6$-th percentage.

Therefore the median is equal to $$\frac{8\%+8\%}{2}=8\%$$

The modeis the value that appears most often, so $8\%$.

For the standard deviation wesubtract from eachgiven value the mean, square the result and take the sum, divide that by the number $10$ and take the square root, right?

So we get $$\sigma=\sqrt{\frac{1}{10}\left [(0.05-0.101)^2+(0.03-0.101)^2+(0.08-0.101)^2+(0.12-0.101)^2+(0.02-0.101)^2+(0.180-0.101)^2+(0.05-0.101)^2+(0.08-0.101)^2+(0.24-0.101)^2+(0.16-0.101)^2\right ]}=\sqrt{\frac{1}{10}\cdot 0.04709}\approx 0.0686$$

The coefficient of variability is $$CV=\frac{\sigma}{\mu}=\frac{0.0686}{0.101}\approx 67.92\%$$ The coefficient of asymmetry is \begin{align*}\beta_1&=\frac{1}{10}\cdot \sum_{i=1}^{10}\left (\frac{x_i-\mu}{\sigma}\right )^3\\ & =\frac{1}{10\cdot \sigma^3}\cdot \left [\left (x_i-\mu\right )^3\right ]\\ & =\frac{1}{10\cdot 0.0686^3}\cdot \left [(0.05-0.101)^3+(0.03-0.101)^3+(0.08-0.101)^3+(0.12-0.101)^3+(0.02-0.101)^3+(0.180-0.101)^3+(0.05-0.101)^3+(0.08-0.101)^3+(0.24-0.101)^3+(0.16-0.101)^3\right ]\\ & =\frac{1}{0.00322828856}\cdot 0.00221772 \\ & \approx 0.68696\end{align*}

Is everything correct so far? How can we interpret the results?

b) Could you give me a hint for that?

c) Do we have to check what distribution we have in this case? Or how can we know that?