logicandtruth

- 14

- 1

Hi all

I am currently working on questions focusing on valuation mathematics. A question on equivalent rates is perplexing me. The first question is straightforward, but I get stuck on the second question.

Q1. What is the value of the right to receive £100,000 annually in advance in perpetuity assuming a discount rate of 10%?

A1. £1,100,000

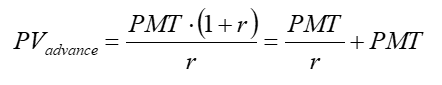

The formula below is for a level annuity that is received in perpetuity and in advance. Here in the UK typically commercial property leases are structured so tenants pay rents four times spread evenly over a year.

View attachment 8408

Q2. What is the value of the right to receive £100,000 per annum quarterly in advance in perpetuity assuming an annual nominal rate of 10%?

A. £1,062,344

I tried various iterations of the formula, but can't get the above answer. Any help would be much appreciated

I am currently working on questions focusing on valuation mathematics. A question on equivalent rates is perplexing me. The first question is straightforward, but I get stuck on the second question.

Q1. What is the value of the right to receive £100,000 annually in advance in perpetuity assuming a discount rate of 10%?

A1. £1,100,000

The formula below is for a level annuity that is received in perpetuity and in advance. Here in the UK typically commercial property leases are structured so tenants pay rents four times spread evenly over a year.

View attachment 8408

Q2. What is the value of the right to receive £100,000 per annum quarterly in advance in perpetuity assuming an annual nominal rate of 10%?

A. £1,062,344

I tried various iterations of the formula, but can't get the above answer. Any help would be much appreciated