- #1

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is America Coddling the Super-Rich?

- News

- Thread starter Lapidus

- Start date

-

- Tags

- Thoughts

In summary, Dave Ramsey was talking about this on his radio show recently. Dave is no Buffet as far as wealth but probably makes a year what Buffet pays in taxes. He said something to the effect, "Mr. Buffet, if you feel that you aren't being taxed enough, write the US government a check. They WILL take your money. But mind your own business." But, I'm sure there are some ridiculous loop-holes we can plug for sanity. One person's "ridiculous loop-hole" is another person's "vital to the national interest." :rolleyes:

Physics news on Phys.org

- #2

drankin

Dave Ramsey was talking about this on his radio show recently. Dave is no Buffet as far as wealth but probably makes a year what Buffet pays in taxes.

He said something to the effect, "Mr. Buffet, if you feel that you aren't being taxed enough, write the US government a check. They WILL take your money. But mind your own business."

But, I'm sure there are some ridiculous loop-holes we can plug for sanity.

He said something to the effect, "Mr. Buffet, if you feel that you aren't being taxed enough, write the US government a check. They WILL take your money. But mind your own business."

But, I'm sure there are some ridiculous loop-holes we can plug for sanity.

Last edited by a moderator:

- #3

jtbell

Staff Emeritus

Science Advisor

Homework Helper

- 15,987

- 6,483

One person's "ridiculous loop-hole" is another person's "vital to the national interest."

(And the other person often has a lot of lobbying money behind him.)

(And the other person often has a lot of lobbying money behind him.)

- #4

WhoWee

- 219

- 0

I've posted this before. Warren Buffet seems to have a political agenda as he doesn't mention the $Billions his company, Berkshire Hathaway, pays in taxes - in addition to his personal taxes. It's unusual for a business owner (someone who built the company from the ground up - not a hired hand) not to consider all of the taxes they pay.

- #5

Norman

- 897

- 4

WhoWee said:I've posted this before. Warren Buffet seems to have a political agenda as he doesn't mention the $Billions his company, Berkshire Hathaway, pays in taxes - in addition to his personal taxes. It's unusual for a business owner (someone who built the company from the ground up - not a hired hand) not to consider all of the taxes they pay.

But that has absolutely nothing to do with the point he is making about personal tax. His point was about personal tax right? (I am not being sarcastic - I read this in snippets between work conversations).

I do find his point about the affects of taxing the rich on the psychology of the middle and working classes.

- #6

Jack21222

- 212

- 1

WhoWee said:I've posted this before. Warren Buffet seems to have a political agenda as he doesn't mention the $Billions his company, Berkshire Hathaway, pays in taxes - in addition to his personal taxes. It's unusual for a business owner (someone who built the company from the ground up - not a hired hand) not to consider all of the taxes they pay.

When Congress wanted to raise personal income taxes on rich people, conservatives rose up and said this would hurt businesses, not realizing there is a difference between business profit and personal income of the owner.

Here, too, you're confusing the two.

- #7

russ_watters

Mentor

- 23,498

- 10,820

That's not true. Like with the split payroll tax, who pays the tax is just a political gimick, not an economic reality.Jack21222 said:When Congress wanted to raise personal income taxes on rich people, conservatives rose up and said this would hurt businesses, not realizing there is a difference between business profit and personal income of the owner.

Here, too, you're confusing the two.

- #8

russ_watters

Mentor

- 23,498

- 10,820

I definitely think a graduated capital gains tax would be a good way to ensure that those who'se normal income is derived from capital gains are taxed appropriately while avoiding penalizing those who invested for retirement, kid's college, etc. I agree with him that that's a flaw in the tax structure. However, I wouldn't make a change until after the economy has shown a stable recovery.

However, most of the rest of that op/ed is highly disingenuous to the point of dishonesty for someone who knows better. He's championed the argument that he pays less % than his secretary in income taxes (here, it's just 'the people in his office'), but:

1. We don't know the incomes of the people in his office. Does anyone actually believe any of them are below the top 20% of wage earners (except, possibly, the janitor - if he even has one on staff)? They are anything but typical/average American workers.

2. All of the non-rich will receive vastly larger benefits from the payroll taxes than him as a fraction of income. The normal calculus of net taxes paid includes the subtraction of benefits, but only for this year. His argument belies the fact that over their lifetimes, his workers are almost certainly net beneficiaries (of payroll taxes) while he's almost certainly a net payer. I wish someone would do a study of overall lifetime net financial contribution to government, because the way the stats are generated now are misleading - and, frankly, insulting if you're a person counted as being a non-contributor while you're only temporarily unemployed. Consier that a person who had a $250k job last year and got laid off might have been seen as "rich", this year he's living a wealthy lifestyle off his checking account, but is considered a poor, non-contributor, and next year perhaps he'll have a new $250k job and be rich again. The stats paint an inaccurate picture of what his real contributions are.

3. He knows enough economics to know that there is no cutoff point in supply and demand below which people buy and above which people don't. For him to say that higher taxes isn't a disincentive to investment is just simply a lie.

4. He's absolutely right that he and his other billionaire friends wouldn't be noticeably hurt by an increase in capital gains taxes. The people who get hurt aren't the 'already rich', but rather the 'trying to become rich' (and even the 'trying to retire comfortably'). He wraps his argument in dishonest false self deprecation: What he's trying to convey as charitable equanimity smells more to me like veiled 'old-money' snobbery. That last part, of course, is pure opinion, though it isn't mine originally - I got it from an op-ed I read a month ago that I'll see if I can find...

However, most of the rest of that op/ed is highly disingenuous to the point of dishonesty for someone who knows better. He's championed the argument that he pays less % than his secretary in income taxes (here, it's just 'the people in his office'), but:

1. We don't know the incomes of the people in his office. Does anyone actually believe any of them are below the top 20% of wage earners (except, possibly, the janitor - if he even has one on staff)? They are anything but typical/average American workers.

2. All of the non-rich will receive vastly larger benefits from the payroll taxes than him as a fraction of income. The normal calculus of net taxes paid includes the subtraction of benefits, but only for this year. His argument belies the fact that over their lifetimes, his workers are almost certainly net beneficiaries (of payroll taxes) while he's almost certainly a net payer. I wish someone would do a study of overall lifetime net financial contribution to government, because the way the stats are generated now are misleading - and, frankly, insulting if you're a person counted as being a non-contributor while you're only temporarily unemployed. Consier that a person who had a $250k job last year and got laid off might have been seen as "rich", this year he's living a wealthy lifestyle off his checking account, but is considered a poor, non-contributor, and next year perhaps he'll have a new $250k job and be rich again. The stats paint an inaccurate picture of what his real contributions are.

3. He knows enough economics to know that there is no cutoff point in supply and demand below which people buy and above which people don't. For him to say that higher taxes isn't a disincentive to investment is just simply a lie.

4. He's absolutely right that he and his other billionaire friends wouldn't be noticeably hurt by an increase in capital gains taxes. The people who get hurt aren't the 'already rich', but rather the 'trying to become rich' (and even the 'trying to retire comfortably'). He wraps his argument in dishonest false self deprecation: What he's trying to convey as charitable equanimity smells more to me like veiled 'old-money' snobbery. That last part, of course, is pure opinion, though it isn't mine originally - I got it from an op-ed I read a month ago that I'll see if I can find...

- #9

RudedawgCDN

Supply Side economics doesn't work.

What works is full employment.

When I'm making money I don't mind paying taxes - I understand that having roads, police, teachers, firefighters = taxes.

Give businesses incentives to keep their money here, their workers here, their plants here - watch employment go up - and then none of this matters.

What works is full employment.

When I'm making money I don't mind paying taxes - I understand that having roads, police, teachers, firefighters = taxes.

Give businesses incentives to keep their money here, their workers here, their plants here - watch employment go up - and then none of this matters.

- #10

mheslep

Gold Member

- 364

- 729

Right, and it is also beside the point whether the individual rich guy is 'hurt' from a macro standpoint. Unless Buffet and the like are literally putting their income under the mattress, they are placing large parts of it in securities, new businesses, i.e. investment, aka the 'I' in the GDP equation. Indeed one can argue Warren Buffet places his investment dollars more thoughtfully than any other human, one heck of a good reason to not send it off to the IRS instead.russ_watters said:...

4. He's absolutely right that he and his other billionaire friends wouldn't be noticeably hurt by an increase in capital gains taxes. The people who get hurt aren't the 'already rich', but rather the 'trying to become rich' ...

- #11

WhoWee

- 219

- 0

Jack21222 said:When Congress wanted to raise personal income taxes on rich people, conservatives rose up and said this would hurt businesses, not realizing there is a difference between business profit and personal income of the owner.

Here, too, you're confusing the two.

How do you separate a man and his company - when these are the stats - he is the one confusing the two - IMO.

http://xfinity.comcast.net/slideshow/finance-topcompanytaxes/berkshire-hathaway/

"8. Berkshire Hathaway

Pretax income: $19 billion

Provision for income taxes: $5.6 billion

Net income: $13 billion

Tax rate: 29 percent

Warren Buffett's empire filed 14,097 pages of tax returns last year. The Oracle of Omaha has for years pushed for higher taxes on the rich, lamenting that his tax rate is lower than his secretary's. "

Last edited by a moderator:

- #12

Willowz

- 197

- 1

A lie? It's a face value statement.russ_watters said:3. He knows enough economics to know that there is no cutoff point in supply and demand below which people buy and above which people don't. For him to say that higher taxes isn't a disincentive to investment is just simply a lie.

Aren't you referring to the middle class in "trying to become rich"? Precisely the people whom he mentioned need helping out??4. He's absolutely right that he and his other billionaire friends wouldn't be noticeably hurt by an increase in capital gains taxes. The people who get hurt aren't the 'already rich', but rather the 'trying to become rich' (and even the 'trying to retire comfortably'). He wraps his argument in dishonest false self deprecation: What he's trying to convey as charitable equanimity smells more to me like veiled 'old-money' snobbery. That last part, of course, is pure opinion, though it isn't mine originally - I got it from an op-ed I read a month ago that I'll see if I can find...

- #13

Ivan Seeking

Staff Emeritus

Science Advisor

Gold Member

- 8,143

- 1,761

WhoWee said:How do you separate a man and his company -

What are you talking about? Corporate vs personal income?

Beyond that, even for an inc., taxable income has no absolute meaning. It depends as much on deductions as it does income. Being an MBA you know that so I don't understand your point here.

- #14

WhoWee

- 219

- 0

Ivan Seeking said:What are you talking about? Corporate vs personal income?

Beyond that, even for an inc., taxable income has no absolute meaning. It depends as much on deductions as it does income. Being an MBA you know that so I don't understand your point here.

STOP! I'm not arguing corporate versus personal tax status and you know it.

I responded to a suggestion that I'm confusing the issue. It's my contention that Buffet built his company from scratch and the company pays $Billions in taxes - if the company wasn't paying those taxes - he would be paying more. His argument is intended to make it appear his (poor little hourly wage secretary) pays more than (rich old him) pays in taxes - and it's laughable.

- #15

Lapidus

- 344

- 12

mheslep said:Right, and it is also beside the point whether the individual rich guy is 'hurt' from a macro standpoint. Unless Buffet and the like are literally putting their income under the mattress, they are placing large parts of it in securities, new businesses, i.e. investment, aka the 'I' in the GDP equation. Indeed one can argue Warren Buffet places his investment dollars more thoughtfully than any other human, one heck of a good reason to not send it off to the IRS instead.

You should write him an email and point that to him out.

Or, you just might again read what he wrote. For your convenience I quote him for you in bold

I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

Also, I think we had clarified that before here on PF on some other thread: big companies, banks and funds are indeed putting there money under the mattress right now. Their hesitance to invest has zero do to with taxes too high, but with the very little business oppurtunities and dim economic outlook.

How low do you want to cut taxes so that people will invest? No taxes? Perhaps paying them to invest? Lower wages, too?

- #16

WhoWee

- 219

- 0

Lapidus said:You should write him an email and point that to him out.

Or, you just might again read what he wrote. For your convenience I quote him for you in bold

I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

Also, I think we had clarified that before here on PF on some other thread: big companies, banks and funds are indeed putting there money under the mattress right now. Their hesitance to invest has zero do to with taxes too high, but with the very little business oppurtunities and dim economic outlook.

How low do you want to cut taxes so that people will invest? No taxes? Perhaps paying them to invest? Lower wages, too?

Has anyone on PF ever read a business plan or Private Placement document that did not include a projection of taxes? Has anyone ever made an investment decision that didn't consider tax consequences? Does anyone believe that Berkshire Hathaway does not factor in tax implications when it considers a merger or acquisition? My earlier post cited "Warren Buffett's empire filed 14,097 pages of tax returns last year." - is it possible taxes were not considered?

Again - you can not separate the man from his company in this discussion.

This is a list of private holdings - follow the links for additional holdings.

http://www.berkshirehathaway.com/subs/sublinks.html

- #17

CAC1001

Lapidus said:I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off.

John Rutledge, who was one of the principle architects of the Reagan economic plan, seems to refute Buffett's claim: http://www.rutledgecapital.com/Articles/20040611_the_real_reaganomics.htm

Note how he points out that investors tended to keep a lot more money in tax shelters but with the tax rate cuts, much more of it began moving into the stock and bond markets. When Labour instituted tax rates up around 90% in the UK during the 70s, it scared off investors as well. The 1970s were a point of virtually zero construction of new mansions in the UK at the time, because no one could really make any money to become wealthy.

And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

This one just baffles me. Is Mr. Buffett forgetting what happened in between 1980 and 2000? We saw some very large tax cuts occur under Ronald Reagan. We saw a tax increase under George H. W. Bush, and one under Bill Clinton, but we also saw a capital gains tax rate cut under Clinton as well. Overall, between 1980 and 2000 was a period of tax cuts and low taxes, and we experienced some of the most vibrant economic growth in the country's history. The 2000s are more complex, because of the housing bubble that messed everything up.

I wouldn't say tax cuts always mean great job growth or that tax increases will automatically kill job growth, but when taxes get punitively high, they do hurt job creation and economic growth.

Last edited by a moderator:

- #18

WhoWee

- 219

- 0

CAC1001 said:John Rutledge, who was one of the principle architects of the Reagan economic plan, seems to refute Buffett's claim: http://www.rutledgecapital.com/Articles/20040611_the_real_reaganomics.htm

Note how he points out that investors tended to keep a lot more money in tax shelters but with the tax rate cuts, much more of it began moving into the stock and bond markets. When Labour instituted tax rates up around 90% in the UK during the 70s, it scared off investors as well. The 1970s were a point of virtually zero construction of new mansions in the UK at the time, because no one could really make any money to become wealthy.

This one just baffles me. Is Mr. Buffett forgetting what happened in between 1980 and 2000? We saw some very large tax cuts occur under Ronald Reagan. We saw a tax increase under George H. W. Bush, and one under Bill Clinton, but we also saw a capital gains tax rate cut under Clinton as well. Overall, between 1980 and 2000 was a period of tax cuts and low taxes, and we experienced some of the most vibrant economic growth in the country's history. The 2000s are more complex, because of the housing bubble that messed everything up.

I wouldn't say tax cuts always mean great job growth or that tax increases will automatically kill job growth, but when taxes get punitively high, they do hurt job creation and economic growth.

The entire capital leasing industry is focused on tax implications on investments.

Further, take a quick look at KPMG's website to understand the tax implications on investment decisions.

my bold

http://www.kpmg.com/global/en/whatwedo/tax/mergersacquisitions/pages/default.aspx

"Why tax-efficient mergers and acquisitions matter

Companies with global ambitions cannot afford to ignore the opportunities for profitable growth offered by mergers, acquisitions and disposals. But if these transactions are to create real value, it is important that the tax implications of each deal are dealt with from the outset. This is especially important in cross-border deals, where differing regulations and business cultures need to be reconciled in order to reveal the risks and opportunities of a transaction.

Similarly, private equity seeking to increase return on investment cannot afford to ignore tax. Recent trends show that M&A transactions have become more international and deal volumes have increased tremendously. Highly-leveraged transactions allow for big ticket deals, in particular within the private equity market."

- #19

mheslep

Gold Member

- 364

- 729

That's about incentive to invest again, another issue and misses my point about allocation: whatever the tax rate, the money that goes to taxes does not go to private investment. If the tax rate is, say 50%, five of ten dollars goes to the government and can not be invested by Buffet regardless of his incentives.Lapidus said:You should write him an email and point that to him out.

Or, you just might again read what he wrote. For your convenience I quote him for you in bold

I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

First, we clarified no such thing. Second, the OP here is about taxes on individuals such as Buffet. Nobody is talking about raising the business tax.Also, I think we had clarified that before here on PF on some other thread: big companies, banks and funds are indeed putting there money under the mattress right now.

Last edited:

- #20

WhoWee

- 219

- 0

mheslep said:First, we clarified no such thing. Second, the OP here is about taxes on individuals such as Buffet."

Actually, there is no one else in the US that is just like Buffet - is there?

Bill Gates has a higher net worth - but it wasn't accumulated primarily through Mergers and Acquisitions -it's primarily from MicroSoft valuation - is't it?

http://www.forbes.com/wealth/billionaires/list

"The venerable investor's Berkshire Hathaway climbed more than 15% over the last year adding $3 billion to his to fortune. The 80-year-old is still hunting big deals: "Our elephant gun has been reloaded, and my trigger finger is itchy." Along with bridge partner Bill Gates, the Oracle of Omaha is coaxing America's richest to pledge half their fortunes to charity."

He apparently can't give his money away fast enough - perhaps he thinks the Government can speed things up?

- #21

russ_watters

Mentor

- 23,498

- 10,820

Willowz said:A lie? It's a face value statement.

Raising taxes on the rich does not help out the 'everyone else'. He explicitly stated he wants to change nothing for the 'everyone else'. What he's calling 'helping out' is actually just not changing the 'helping out' that Obama and Bush already did.Aren't you referring to the middle class in "trying to become rich"? Precisely the people whom he mentioned need helping out??

Last edited:

- #22

DevilsAvocado

Gold Member

- 848

- 91

CAC1001 said:I wouldn't say tax cuts always mean great job growth or that tax increases will automatically kill job growth, but when taxes get punitively high, they do hurt job creation and economic growth.

In theory, maybe yes, in practice – I say it all depends on how you do it. If you do investments in infrastructure, education, research, new technology, startups, etc – high taxes can actually mean a growing economy.

I can’t help laughing when I see (the same old freaks) going baloney over taxes, as it was some form of communist virus from hell.

I live in a country which has one of the highest taxes in the world, as a percentage of GDP:

As you can see, we have twice as much tax revenues as the United States, TWICE!

Do we walk around in Karl Marx beards and fight over the one and only loaf in the supermarket?

No.

At the moment, we are http://en.wikipedia.org/wiki/EU_economy#Economies_of_member_states", 5.54% annual change of GDP, and United States has 2.8%.

This means you have a *HUGE* opportunity (i.e. margin) to fix your economy in a fairly simple way, if you could just relax a little bit, and realize that taxes are not equal to Stalinism.

... and if I just may add; you have http://en.wikipedia.org/wiki/Health_care_system#Cross-country_comparisons", 17% of GDP and growing:

If you fix the healthcare and make it more effective and thus cheaper, raise some to taxes to fix your public debt, do some cuts (in maybe some 'overkill' in the military), and skip stupid gazillionaire benefits like tax reduction for private jets – you’re are going to do JUST FINE!

Piece of cake!

Last edited by a moderator:

- #23

russ_watters

Mentor

- 23,498

- 10,820

He's arguing against the law of supply and demand. Incentives and disincentives are the positive and negative of the same thing. They are both quite real and they both really do work.Lapidus said:You should write him an email and point that to him out.

Or, you just might again read what he wrote. For your convenience I quote him for you in bold

...I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off.

Consider the following scenario: You have some money in the stock market and are nearing retirement. You plan to take quite a bit of money out when you retire. Capital gains taxes are about to rise a lot. Do you keep your money in the stock market or take it out early? Some people will elect to take it out early.

Cash for clunkers and the new homebuyer credits worked similarly and their effects - though temporary - were well documented.

Also, imagine you're a casual trader who has short term investments. The fact that the capital gains tax is lower than income taxes provides an incentive for keeping your money in the market and in an individual stock for longer than a year. Remove that incentive and some people may trade more, increasing volatility and potentially removing money from the market.

Does anyone not see the deception in that part? It's terrible! He's whitewashing the primary component of the Reagan legacy (which both sides of the aisle agree on!)!And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

I don't know why you bring that up - this isn't about business investment, but personal investment.Also, I think we had clarified that before here on PF on some other thread: big companies, banks and funds are indeed putting there money under the mattress right now. Their hesitance to invest has zero do to with taxes too high, but with the very little business oppurtunities and dim economic outlook.

Who said anything about cutting taxes? This is about whether or not to raise taxes. That's a red-herring argument.How low do you want to cut taxes so that people will invest? No taxes? Perhaps paying them to invest? Lower wages, too?

Last edited:

- #24

WhoWee

- 219

- 0

Lapidus said:How low do you want to cut taxes so that people will invest? No taxes? Perhaps paying them to invest?

Isn't this the specific basis and intent of President Obama's tax policy - to cut payroll taxes for 95% of all workers - so they invest in the economy? Doesn't the EITC (tax redistribution) program give money to low income families - so they can invest in the economy?

- #25

mheslep

Gold Member

- 364

- 729

Yes US healthcare is too expensive, due to government intervention in the market in my opinion. US medicine also yields considerably better medical outcomes than Europe, which is a fact.DevilsAvocado said:If you fix the healthcare and make it more effective and thus cheaper,

- #26

Willowz

- 197

- 1

Mis-wording on my part there. But, I don't understand what you meant by "trying to get rich" not benefiting from Buffet's proposal. I think you meant "the already rich" would not benefit.russ_watters said:Raising taxes on the rich does not help out the 'everyone else'. He explicitly stated he wants to change nothing for the 'everyone else'. What he's calling 'helping out' is actually just not changing the 'helping out' that Obama and Bush already did.

- #27

Physics-Learner

- 297

- 0

once again, the answer is simple - get rid of most of govt. it is the root cause of most all of our problems.

- #28

DevilsAvocado

Gold Member

- 848

- 91

mheslep said:Yes US healthcare is too expensive, due to government intervention in the market in my opinion. US medicine also yields considerably better medical outcomes than Europe, which is a fact.

Really? That’s not what I have heard:

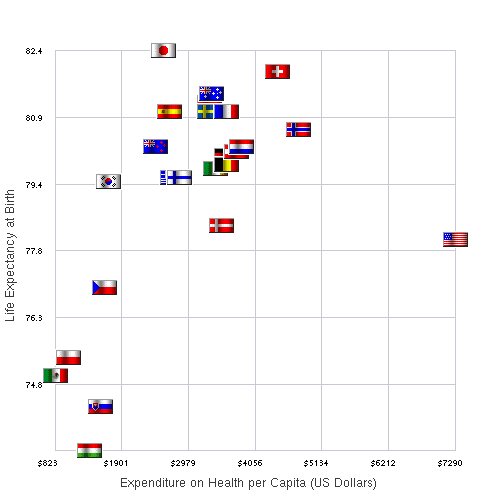

Life Expectancy vs Health Care Spending in 2007 for OECD Countries. The data source is http://www.oecd.org

Do you have another source?

- #29

DevilsAvocado

Gold Member

- 848

- 91

Physics-Learner said:once again, the answer is simple - get rid of most of govt. it is the root cause of most all of our problems.

I know exactly what you mean. Somalia is a financial paradise.

- #30

lisab

Staff Emeritus

Science Advisor

Gold Member

- 2,026

- 624

Physics-Learner said:once again, the answer is simple - get rid of most of govt. it is the root cause of most all of our problems.

Very simplistic world view, IMO.

- #31

Physics-Learner

- 297

- 0

lisab said:Very simplistic world view, IMO.

as mr. spock would say - "why, thank you".

- #32

russ_watters

Mentor

- 23,498

- 10,820

There couldn't be a less reliable stat than life expectancy on that issue. Cultural and government bias issues play such a huge role that the relatively tiny differences are swamped by the noise.DevilsAvocado said:Really? That’s not what I have heard:

Life Expectancy vs Health Care Spending in 2007 for OECD Countries. The data source is http://www.oecd.org

Do you have another source?

- #33

WhoWee

- 219

- 0

I'm going to re-post and hi-lite with bold the important point:

"http://www.forbes.com/wealth/billionaires/list

"The venerable investor's Berkshire Hathaway climbed more than 15% over the last year adding $3 billion to his to fortune. The 80-year-old is still hunting big deals: "Our elephant gun has been reloaded, and my trigger finger is itchy." Along with bridge partner Bill Gates, the Oracle of Omaha is coaxing America's richest to pledge half their fortunes to charity.""

This man is on a mission to give his fortune away - his comments about higher taxes on the wealthy should be kept in context with this important stipulation.

"http://www.forbes.com/wealth/billionaires/list

"The venerable investor's Berkshire Hathaway climbed more than 15% over the last year adding $3 billion to his to fortune. The 80-year-old is still hunting big deals: "Our elephant gun has been reloaded, and my trigger finger is itchy." Along with bridge partner Bill Gates, the Oracle of Omaha is coaxing America's richest to pledge half their fortunes to charity.""

This man is on a mission to give his fortune away - his comments about higher taxes on the wealthy should be kept in context with this important stipulation.

- #34

- 19,560

- 10,355

I was thinkin, if he wants to pay more taxes, why doesn't he just write a check to the US Treasury?

- #35

Physics-Learner

- 297

- 0

choose whatever you want. i will supply you with a statistic to back it up.

Similar threads

- Replies

- 382

- Views

- 28K

- Replies

- 6

- Views

- 2K

- Replies

- 51

- Views

- 7K

- Replies

- 24

- Views

- 5K

- Replies

- 95

- Views

- 15K

- Replies

- 4

- Views

- 3K

- Replies

- 69

- Views

- 8K

- Replies

- 21

- Views

- 10K

- Replies

- 9

- Views

- 4K

- Replies

- 4

- Views

- 3K

Share: