fog37

- 1,566

- 108

- TL;DR Summary

- Checking for normality of errors and residuals in ordinary linear regression

Hello,

In reviewing the classical linear regression assumptions, one of the assumptions is that the residuals have a normal distribution...I also read that this assumption is not very critical and the residual don't really have to be Gaussian.

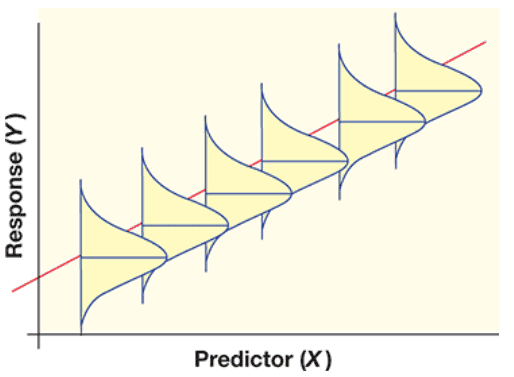

That said, the figure below show ##Y## values and their residuals with a normal distribution of equal variance at the ##X## value:

To check for residual normality, should we check the distribution of residuals at each ##X## (not very practical)? Instead, we usually plot a histogram of ALL the residuals at different X values...But that is not what the assumption is about (normality of residuals for each predictor ##X## value)...

Thank you...

In reviewing the classical linear regression assumptions, one of the assumptions is that the residuals have a normal distribution...I also read that this assumption is not very critical and the residual don't really have to be Gaussian.

That said, the figure below show ##Y## values and their residuals with a normal distribution of equal variance at the ##X## value:

To check for residual normality, should we check the distribution of residuals at each ##X## (not very practical)? Instead, we usually plot a histogram of ALL the residuals at different X values...But that is not what the assumption is about (normality of residuals for each predictor ##X## value)...

Thank you...