- #1

BWV

- 1,524

- 1,863

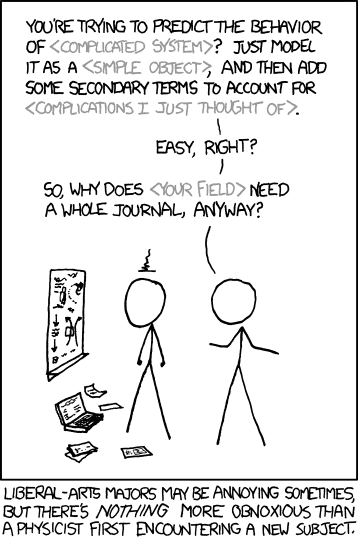

Nature recently published this piece with another physicist (Ole Peters from the Santa Fe Institute) trying to 'fix' economics:

https://www.nature.com/articles/s41567-019-0732-0

With a short paper that, to my reading, just comes up with a toy model of geometric brownian motion with a small positive expectation but high variance, so that ergodicity (defined as a finite time average <> infinite time expectation value) is violated for relativity short time periods. The model is simply a coin toss where you gain 50% on a win and lose 40% on a loss. A finite even number of wins and losses will result in an overall loss, but the large right tail makes the overall expectation positive. He goes on to discuss utility and the St Petersburg paradox

While the media loves these 'outsider fixes economics' stories, this seems really trivial, and understandably the reaction by economists has not been kind, and reveals Peter's argument as largely a straw man

https://static-content.springer.com...x/MediaObjects/41567_2020_1106_MOESM1_ESM.pdf

https://www.nature.com/articles/s41567-019-0732-0

The ergodic hypothesis is a key analytical device of equilibrium statistical mechanics. It underlies the assumption that the time average and the expectation value of an observable are the same. Where it is valid, dynamical descriptions can often be replaced with much simpler probabilistic ones — time is essentially eliminated from the models. The conditions for validity are restrictive, even more so for non-equilibrium systems. Economics typically deals with systems far from equilibrium — specifically with models of growth. It may therefore come as a surprise to learn that the prevailing formulations of economic theory — expected utility theory and its descendants — make an indiscriminate assumption of ergodicity. This is largely because foundational concepts to do with risk and randomness originated in seventeenth-century economics, predating by some 200 years the concept of ergodicity, which arose in nineteenth-century physics. In this Perspective, I argue that by carefully addressing the question of ergodicity, many puzzles besetting the current economic formalism are resolved in a natural and empirically testable way.

With a short paper that, to my reading, just comes up with a toy model of geometric brownian motion with a small positive expectation but high variance, so that ergodicity (defined as a finite time average <> infinite time expectation value) is violated for relativity short time periods. The model is simply a coin toss where you gain 50% on a win and lose 40% on a loss. A finite even number of wins and losses will result in an overall loss, but the large right tail makes the overall expectation positive. He goes on to discuss utility and the St Petersburg paradox

While the media loves these 'outsider fixes economics' stories, this seems really trivial, and understandably the reaction by economists has not been kind, and reveals Peter's argument as largely a straw man

https://static-content.springer.com...x/MediaObjects/41567_2020_1106_MOESM1_ESM.pdf