- #1

- 1,126

- 643

- TL;DR Summary

- Difference between W(x) and Wn(x) ?

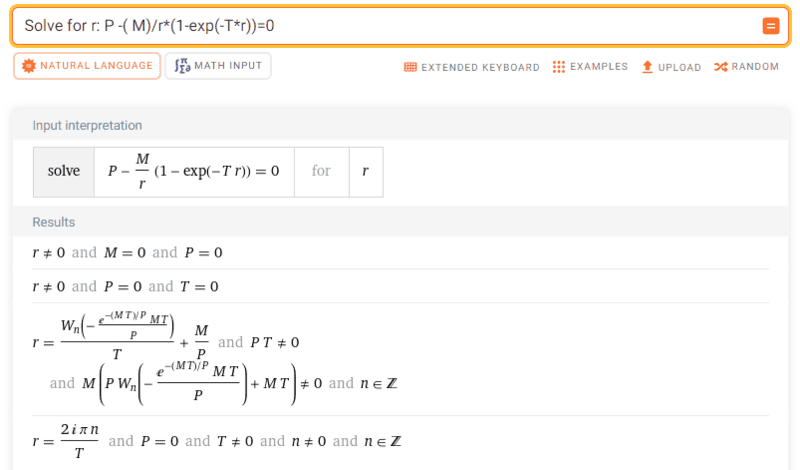

In the following I ask WA to solve the given equation and it produces a solution using the Lambert W function.

I thought : $$W(x*e^x) = x$$ but here it seems $$W_n \left(\frac{-MT}{P}*e^{\frac{-MT}{P}}\right) \neq \frac{-MT}{P}$$

Is there a difference between ##W(x)## and ##W_n(x)## ?

I thought : $$W(x*e^x) = x$$ but here it seems $$W_n \left(\frac{-MT}{P}*e^{\frac{-MT}{P}}\right) \neq \frac{-MT}{P}$$

Is there a difference between ##W(x)## and ##W_n(x)## ?

Last edited: