- #1

logicandtruth

- 15

- 1

Hi All - Would appreciate some help on this please.

Query on level annuities

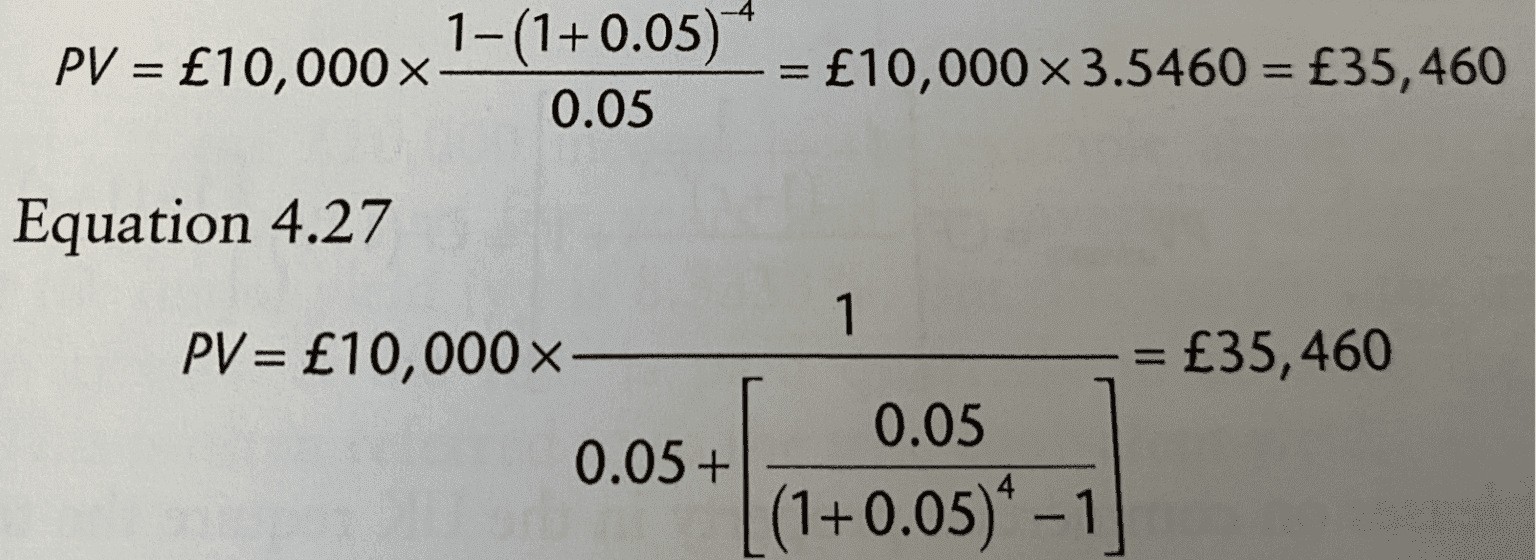

Q. What is the present value of an investment with an annual income of £10,000 over the next for years at a return of 5% per annum?

A - first image below. I appreciate that the second equation though gives the same correct answer of £35,460, it would be used if the remunerative and accumulative rates were different.

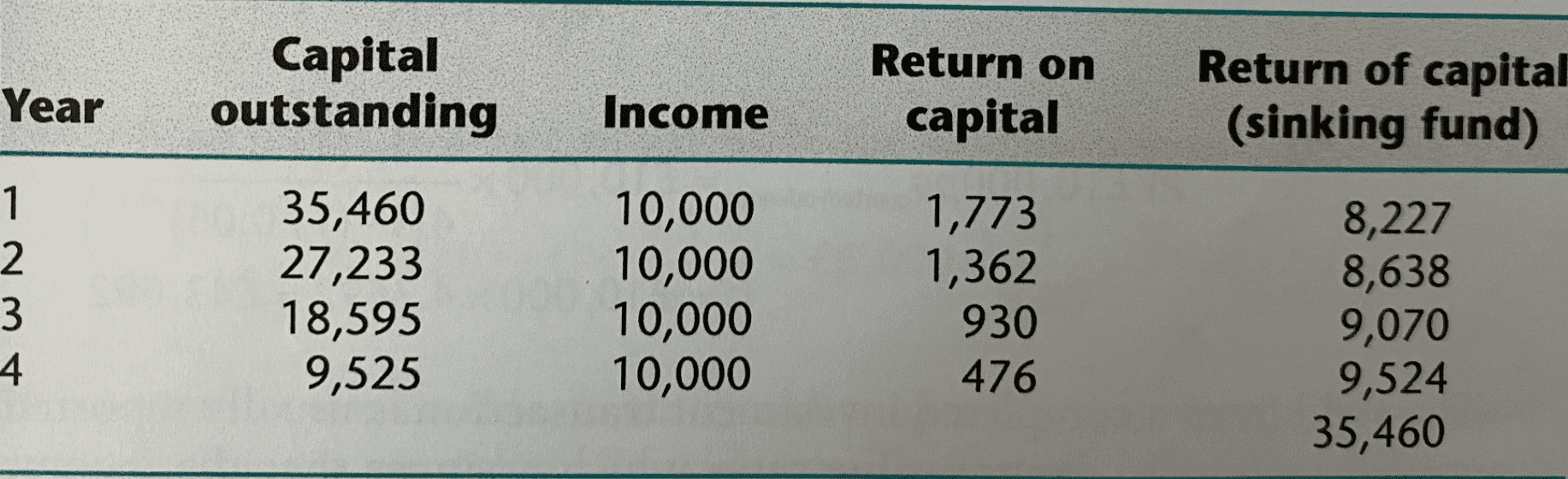

The below image provides a return on and of capital broken down year-by-year. Please could you advise how the figures in the column titled 'return of capital (sinking fund)' are calculated

Query on level annuities

Q. What is the present value of an investment with an annual income of £10,000 over the next for years at a return of 5% per annum?

A - first image below. I appreciate that the second equation though gives the same correct answer of £35,460, it would be used if the remunerative and accumulative rates were different.

The below image provides a return on and of capital broken down year-by-year. Please could you advise how the figures in the column titled 'return of capital (sinking fund)' are calculated