WMDhamnekar

MHB

- 376

- 28

- Homework Statement

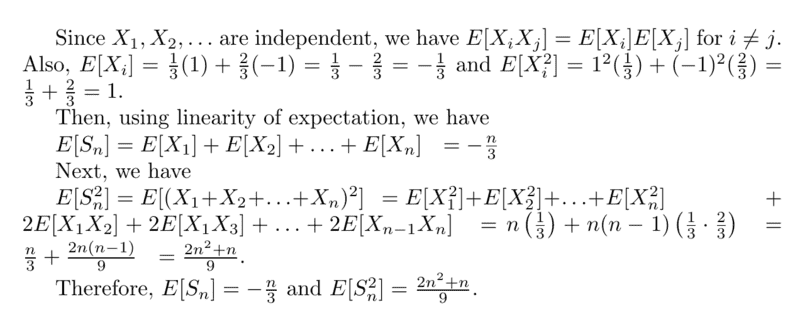

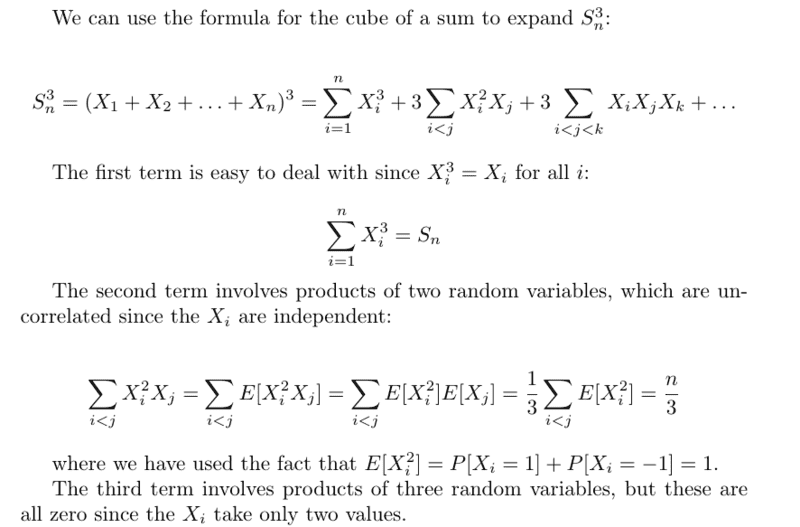

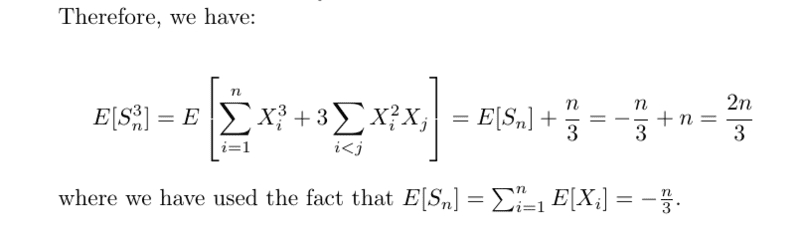

- Suppose ##X_1,X_2 \dots ## are independent random variables with ##\mathbb{P}[X_j= 1] =1- \mathbb{P}[X_j=-1]=\frac13## Let ## S_n = X_1 +\dots +X_n## Find ## \mathbb{E}[S_n], \mathbb{E}[S^2_n], \mathbb{E}[S^3_n]##

- Relevant Equations

- Not applicable

Are my following answers correct?

Last edited: