myklfitz

- 1

- 0

Hi,

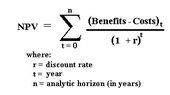

Here's the classic NPV equation:

View attachment 4720

For my purposes all terms are known, including the NPV and Benefits, except Costs. I would like to solve this equation for Costs.

Is this possible?

Thanks,

Mike

Here's the classic NPV equation:

View attachment 4720

For my purposes all terms are known, including the NPV and Benefits, except Costs. I would like to solve this equation for Costs.

Is this possible?

Thanks,

Mike