TimeSkip

- 44

- 4

A short primer for the topic can be found here:

https://econ243.academic.wlu.edu/2017/04/07/disruptive-deflationary-technology/

Mainly the gist of the issue has to do with technology such as, cell phones, the internet, artificial intelligence, automated services, increasing efficiency and other productivity measures in the economy to create a decrease in prices for the consumer in the economy.

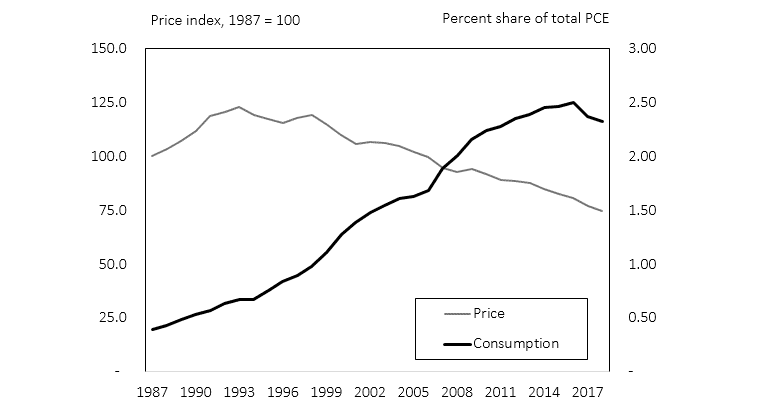

Since the start of the dot com boom consumer prices for digital products have been falling, as seen in the following.

https://www.federalreserve.gov/econ...consumer-digital-access-services-20200715.htm

With the advent of Amazon in the US or Alibaba in China, this effect has spread and slightly accelerated in the economy. There are suspicions that the net effect will contribute to a better life for the consumer due to decreasing costs of hedonic goods such as Netflix or the next 4k TV. It has puzzled me that companies like Apple have been able to survive on its iPhone for so long.

What interests me most are the long term trajectories for a fiat system to survive in a competitive environment. I simply don't see the growth of the economy prospering very well with a US Federal minimum wage of some seven dollars, with growing apathy from the public sector towards progress when the typification of consumer behavior is towards the need for more non-essential goods such as Hulu, online games such as World of Warcraft or Call of Duty, faster internet, and etc.

In a recent news article from Bloomberg, it is said that this tendency has increased or sped up during COVID-19. They say:

Online retailers would continue to benefit from stay-at-home consumers but the pressure on shopping malls would intensify. Many more heavily-leveraged retailers and others with huge debt service would fold.

See.

Now that COVID-19 is coming to an end and new economic trends are arising, my concern or question arising from the above is a question about what will likely happen in the near future due to these tendencies in the economy arising and being enhanced by further more intelligent AI.

I don't mean to sound off my rocker; but, the ever high envious interest of the rich by a rather minimum wage worker as myself would find has been decreasing or dissipating. What are your economic forecasts of consumer behavior or economic tendencies due to the above information provided? Demographics show that there are more retired individuals rather than workers in the economy. Many young adults don't have stable jobs and work online making money from this new sector, which poses a threat to existing industries seeking new job applicants. With the advent of Generalized Artificial Intelligence, this trend will no doubt continue for as long as foresight allows.

So, what are your thoughts?

https://econ243.academic.wlu.edu/2017/04/07/disruptive-deflationary-technology/

Mainly the gist of the issue has to do with technology such as, cell phones, the internet, artificial intelligence, automated services, increasing efficiency and other productivity measures in the economy to create a decrease in prices for the consumer in the economy.

Since the start of the dot com boom consumer prices for digital products have been falling, as seen in the following.

https://www.federalreserve.gov/econ...consumer-digital-access-services-20200715.htm

With the advent of Amazon in the US or Alibaba in China, this effect has spread and slightly accelerated in the economy. There are suspicions that the net effect will contribute to a better life for the consumer due to decreasing costs of hedonic goods such as Netflix or the next 4k TV. It has puzzled me that companies like Apple have been able to survive on its iPhone for so long.

What interests me most are the long term trajectories for a fiat system to survive in a competitive environment. I simply don't see the growth of the economy prospering very well with a US Federal minimum wage of some seven dollars, with growing apathy from the public sector towards progress when the typification of consumer behavior is towards the need for more non-essential goods such as Hulu, online games such as World of Warcraft or Call of Duty, faster internet, and etc.

In a recent news article from Bloomberg, it is said that this tendency has increased or sped up during COVID-19. They say:

Online retailers would continue to benefit from stay-at-home consumers but the pressure on shopping malls would intensify. Many more heavily-leveraged retailers and others with huge debt service would fold.

See.

Now that COVID-19 is coming to an end and new economic trends are arising, my concern or question arising from the above is a question about what will likely happen in the near future due to these tendencies in the economy arising and being enhanced by further more intelligent AI.

I don't mean to sound off my rocker; but, the ever high envious interest of the rich by a rather minimum wage worker as myself would find has been decreasing or dissipating. What are your economic forecasts of consumer behavior or economic tendencies due to the above information provided? Demographics show that there are more retired individuals rather than workers in the economy. Many young adults don't have stable jobs and work online making money from this new sector, which poses a threat to existing industries seeking new job applicants. With the advent of Generalized Artificial Intelligence, this trend will no doubt continue for as long as foresight allows.

So, what are your thoughts?