You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MHB What is the correct formula for calculating savings plan?

- Thread starter Ladybug101

- Start date

-

- Tags

- Plan Word problem

AI Thread Summary

The correct formulas for calculating a savings plan depend on when deposits are made: at the end of the month or the beginning. For end-of-month deposits, use the formula S_Ordinary = p[(1 + r/n)^(ny) - 1] / (r/n). For beginning-of-month deposits, the formula is S_Due = p[(1 + r/n)^(ny) - 1] / (r/n) * (1 + r/n). The choice between these formulas affects the future value of the savings plan. Clarifying the timing of deposits is essential for accurate calculations.

Mathematics news on Phys.org

jonah1

- 107

- 0

Beer induced opinions follow. In no event shall the wandering math knight-errant Sir jonah in his inebriated state be liable to anyone for special, collateral, incidental, or consequential damages in connection with or arising out of the use of his beer inspired views.

Alas Milady, that formula you gave is incorrect.

That should either be

$$S_{Ordinary}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}}$$

OR

$$S_{Due}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}}\left(1+\frac{r}{n}\right)$$

where we replace $A$ (which denotes the present value) with $S$ (which denotes the future value).

It depends upon when you plan to make your monthly deposit, that is, at the end of the month (1st formula, future value of an ordinary annuity or end of period payments/deposits) or at the beginning of the month (very likely, 2nd formula, future value of an annuity due or beginning of period payments/deposits).

The question now is when do you plan to make your monthly deposits - at the beginning of the month or at the end of the month - to accumulate 30,000 at the end of 5 years. After you've made that clarification, it boils down to a mere plug and chug routine. You can try both if you like and compare the resulting $p$'s with your textbook's answer section if your problem is from a textbook.

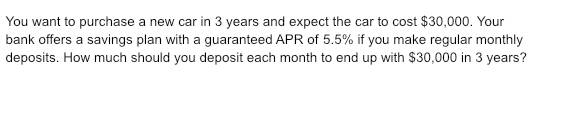

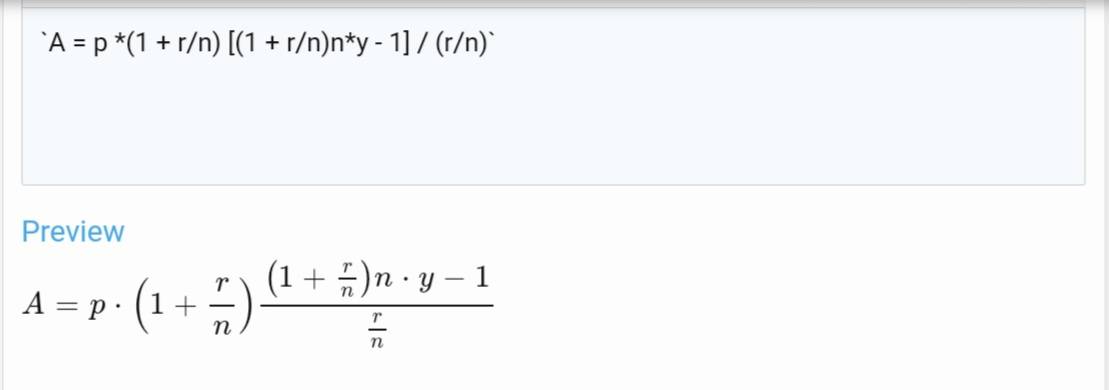

Ladybug101 said:Hello! I am having trouble with this question. Please look at the image. I understand that I’m supposed to use the A = p *(1 + r/n) [(1 + r/n)n*y - 1] / (r/n) formula but I’m really stuck on this problem.

Alas Milady, that formula you gave is incorrect.

That should either be

$$S_{Ordinary}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}}$$

OR

$$S_{Due}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}}\left(1+\frac{r}{n}\right)$$

where we replace $A$ (which denotes the present value) with $S$ (which denotes the future value).

It depends upon when you plan to make your monthly deposit, that is, at the end of the month (1st formula, future value of an ordinary annuity or end of period payments/deposits) or at the beginning of the month (very likely, 2nd formula, future value of an annuity due or beginning of period payments/deposits).

The question now is when do you plan to make your monthly deposits - at the beginning of the month or at the end of the month - to accumulate 30,000 at the end of 5 years. After you've made that clarification, it boils down to a mere plug and chug routine. You can try both if you like and compare the resulting $p$'s with your textbook's answer section if your problem is from a textbook.

Seemingly by some mathematical coincidence, a hexagon of sides 2,2,7,7, 11, and 11 can be inscribed in a circle of radius 7. The other day I saw a math problem on line, which they said came from a Polish Olympiad, where you compute the length x of the 3rd side which is the same as the radius, so that the sides of length 2,x, and 11 are inscribed on the arc of a semi-circle. The law of cosines applied twice gives the answer for x of exactly 7, but the arithmetic is so complex that the...

A power has two parts. Base and Exponent.

A number 423 in base 10 can be written in other bases as well:

1. 4* 10^2 + 2*10^1 + 3*10^0 = 423

2. 1*7^3 + 1*7^2 + 4*7^1 + 3*7^0 = 1143

3. 7*60^1 + 3*60^0 = 73

All three expressions are equal in quantity. But I have written the multiplier of powers to form numbers in different bases. Is this what place value system is in essence ?

Is it possible to arrange six pencils such that each one touches the other five? If so, how? This is an adaption of a Martin Gardner puzzle only I changed it from cigarettes to pencils and left out the clues because PF folks don’t need clues. From the book “My Best Mathematical and Logic Puzzles”. Dover, 1994.

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 6

- Views

- 2K

- Replies

- 2

- Views

- 1K

- Replies

- 7

- Views

- 3K

- Replies

- 6

- Views

- 1K

- Replies

- 1

- Views

- 2K

- Replies

- 4

- Views

- 2K

- Replies

- 2

- Views

- 4K

- Replies

- 11

- Views

- 1K

- Replies

- 2

- Views

- 11K

Hot Threads

-

Insights Fermat's Last Theorem

- Started by fresh_42

- Replies: 105

- General Math

-

B What could prove this wrong? I'm having a dispute with friends

- Started by ducknumerouno

- Replies: 94

- General Math

-

B About a definition: What is the number of terms of a polynomial P(x)?

- Started by littlemathquark

- Replies: 48

- General Math

-

B Geometry Puzzle with 20 points in a cross pattern

- Started by bob012345

- Replies: 31

- General Math

-

I Geometry problem of interest with a 3-4-5 triangle

- Started by Charles Link

- Replies: 59

- General Math

Recent Insights

-

Insights Thinking Outside The Box Versus Knowing What’s In The Box

- Started by Greg Bernhardt

- Replies: 1

- Other Physics Topics

-

Insights Why Entangled Photon-Polarization Qubits Violate Bell’s Inequality

- Started by Greg Bernhardt

- Replies: 28

- Quantum Interpretations and Foundations

-

Insights Quantum Entanglement is a Kinematic Fact, not a Dynamical Effect

- Started by Greg Bernhardt

- Replies: 11

- Quantum Physics

-

Insights What Exactly is Dirac’s Delta Function? - Insight

- Started by Greg Bernhardt

- Replies: 3

- General Math

-

Insights Relativator (Circular Slide-Rule): Simulated with Desmos - Insight

- Started by Greg Bernhardt

- Replies: 1

- Special and General Relativity

-

Insights Fixing Things Which Can Go Wrong With Complex Numbers

- Started by PAllen

- Replies: 7

- General Math